What is Payments Direction?

Payments Direction is our cornerstone strategic initiative to understand the evolving future of payments. Through this programme we work collaboratively with the industry to identify what needs to be done to contribute to and prepare for that future.

Over time, this programme has been responsible for several key initiatives and deliverables comprising one-off projects, yearly research and thought leadership and ongoing operational activity in line with industry and Board priorities.

Payments Direction is the strategic initiative that is helping us work towards achieving our vision of world class payments for Aotearoa New Zealand.

What have we been working on?

We’ve published a whitepaper on digital identity in the digital economy, examining its current state and how digital identity can help make payments safer in Aotearoa.

Find out more about this work and view our digital identity in the digital economy paper here.

Our whitepaper builds on the insights and recommendations in our Payments NZ Digital Identity May 2024 Workshop Paper and several initiatives for the issuance and storage of government-issued digital identity credentials, we have kicked off an initial investigation sprint into how the payments ecosystem could utilise emerging technology in the digital identity landscape.

What are we working on next?

The insights and outcomes from our sprint and further industry engagement will form the basis of our future work activities and deliverables. These findings will also be used to inform other Payments NZ initiatives, including our consolidated strategic roadmap and the next generation payments programme.

What work have we done so far?

2025 Environmental Scan Report

Each year we undertake an environmental scan to track changes and developments across strategic areas of focus for the payments industry to help guide decision making, and every second year we publish a report of those findings.

Our 2025 scan is centred around the digital revolution in payments.

Payments NZ Environmental Scan 2025 (1.8 MB)

Next generation payments

In our next generation payments programme, we work with our industry stakeholders to understand what an enduring, sustainable, safe, and equitable next generation payments ecosystem could look like. In September 2024, we released a consultation paper which set out our thoughts on how a next generation system could come together, including a proposed design centred on safe, secure, data-rich payments.

Read more about the work of the Next generation payments programme here.

Consumer Research 2024

In 2024 we conducted our fifth instalment of our biennial research programme, which is designed to understand how consumers across Aotearoa are paying now and how they want to pay in the future.

Key insights this year cover payment preferences, open banking, the future of payments and vulnerable New Zealanders, as well as specific consumer behaviour insights from Māori respondents.

Payments NZ Consumer Research 2024 (3.0 MB)

2022 Environmental Scan Report

Our 2022 scan highlighted the proliferation of digital payment solutions that are increasingly embedded into other digital offerings. We also noted a trend for global governments to focus on creating digital infrastructures and policies that support country-specific ambitions to become world class digital nations. There’s also an intensified policy focus on addressing financial inclusion and protecting vulnerable consumers.

Payments Modernisation Plan Discussion Document

The Payments Modernisation Plan (PMP) is based on five guiding principles that put Kiwi at the heart of everything we do. The principles that guide our modernisation activities are to:

- help Kiwi achieve their financial goals

- improve financial inclusion

- build a more productive Aotearoa

- improve the financial resilience of Kiwi businesses and consumers

- support competition and innovation to give Kiwi more choice in payments.

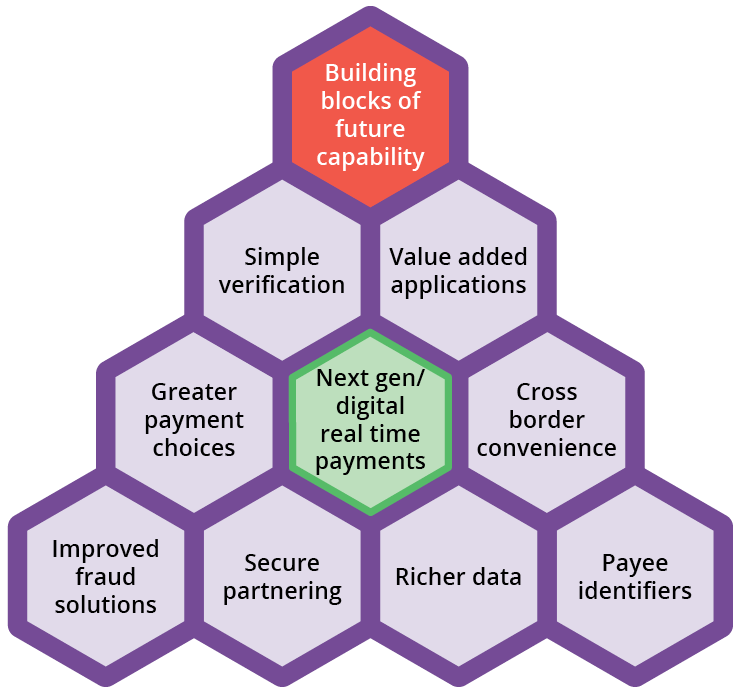

The PMP also identifies a range of capability building blocks that will be required to modernise the payments ecosystem across Aotearoa. Each of these building blocks has the potential to address current or emerging limitations in the payments ecosystem and play an important part in delivering a vibrant and dynamic future payments ecosystem.

Since the release of the PMP we have made progress towards some of the above core building block capabilities:

Value added applications, greater payment choices, and secure partnering

The work of our API Centre supports bringing value added applications and greater payment choices into the ecosystem safely and securely.

Richer data

ISO20022 has created a common language and model for data in the context of high value and cross-border transactions.

Payments Modernisation Plan (1.2 MB)

Shared industry API framework (Completed)

This workstream investigated the establishment of open banking API standards and a shared API framework which outlined how organisations can access, use, and contribute to the development of those standards. This workstream concluded with the release of version 1.0.0 of our pilot API standards and establishment of our API Centre .

365-day service availability (Completed)

This workstream considered an extension to the availability of payment systems to allow payments, for example direct credits or bill payments, to be made and received 365 days of the year. This workstream was completed in 2023 with the successful transition of the industry to 365-day payments.

Why are we doing this work?

The financial services sector and payments industry continues to evolve at a rapid pace. Therefore, it's vitally important for organisations and the industry to stay informed about the developments driving this evolution and ensure they're prepared for the future. This is particularly true for the payments industry, which is highly networked and open to the adoption of new technologies and business models. In this environment, efficiency, safety, innovation, openness, and interoperability are fundamental.

How we work

Payments Direction is an industry-led initiative and the way we work reflects this approach.

Facilitation and collaboration are key features of the Payments Direction programme. As such, we work with our Participants and Members and interested parties, government and regulators across the wider ecosystem who each brings a variety of insights and perspectives to the work we do.

Want to know more or get involved?

If you work at one of our Participant or Member organisations, it's likely you have colleagues connected to or working directly with this programme. Ask your colleagues about how you can get involved or contact us.

If you are part of the wider payments ecosystem and want more information or to get involved, please feel free to contact us.

In this section

Digital identity

Our whitepaper, Digital identity in the digital economy, is now available. In it, we explore how digital identity services can help make payments safer in Aotearoa New Zealand. The paper is part of our Payments Direction strategic programme, which looks at what needs to be done to prepare for the evolving future of payments.

Read more