NZ payments stats - a year in review

11 Nov 2015

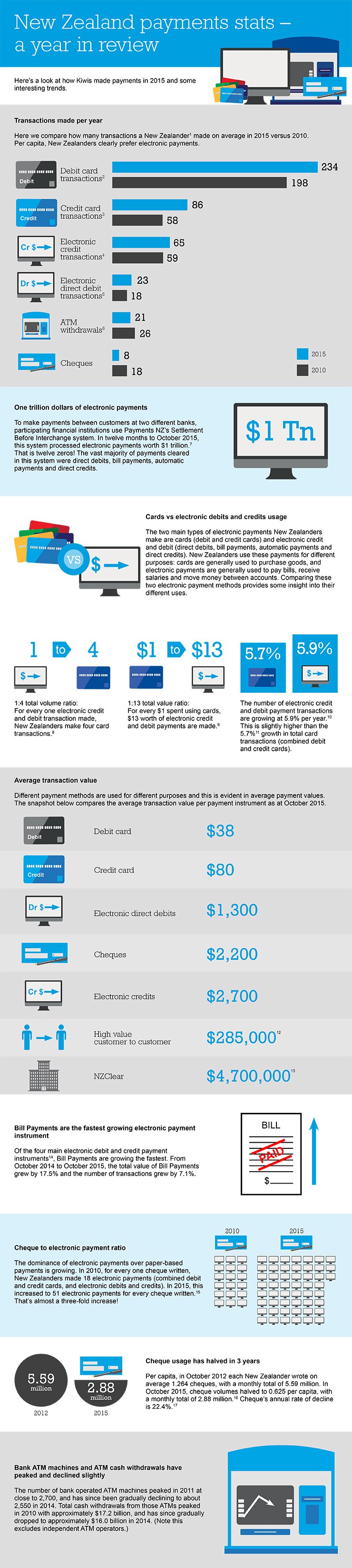

1. Based on a population of 4,609,000 as at October 2015 and 4,362,0700 as at October 2010. Source Statistics NZ. 2. Source statistics NZ. For period Nov 2014 – Oct 2015, and for period Nov 2009 – Oct 2010. 3. ibid 4. 12 months to October 2015 and 12 months Nov 2009 – Oct 2010. Electronic credits included are direct credits, bill payments, and automatic payments. Electronic credits exclude transactions between two customers of the same bank. Including these transactions would make the numbers higher. 5. 12 months to October 2015 and 12 months Nov 2009 – Oct 2010. Direct debits exclude transactions between two customers of the same bank. Including these transactions would make the numbers higher. 6. ATM withdrawals are from bank owned ATM machines only and exclude transactions from independent ATM operators. Calculated using total 2010 and 2014 total cash withdrawals. 7. $1.04 trillion. Note this excludes transactions between two customers of the same bank. Including these transactions would make this number higher. 8. Based on 1,473.5 million debit and credit card transactions from Nov 2014 to Oct 2015 compared to 405.8 total direct debits, bill payments, automatic payments and direct credits cleared through the Settlement Before Interchange system for the same period. Note that the Settlement Before Interchange system excludes payments between two customers at the same bank (called on-us transactions), whereas card payments between a cardholder and a merchant who use the same bank are included. Including on-us transactions would decrease the ratio further. 9. Based on $74.4 billion total credit and debit card value from Nov 2014 to Oct 2015 compared to $948.2 total direct debits, bill payments, automatic payments and direct credits cleared through the Settlement Before Interchange system for the same period. Including on-us transactions would increase the ratio further. 10. Combined volume of direct debits, bill payments, automatic payments and direct credits cleared through the Settlement Before Interchange system in 12 months from Nov 2014 to Oct 2015 totalled 405.7 million transactions. This was 5.852% higher than twelve months prior (Nov 2013 to Oct 2014), which totalled 383.3 million. Data source Payments NZ. 11. Combined debit card and credit card volumes in 12 months from Nov 2014 to Oct 2015 totalled 1,473.5 million transactions. This was 5.71% higher than twelve months prior (Nov 2013 to Oct 2014), which totalled 1,394 million. Data source Statistics NZ. 12. High value customer-to-customer payments are MT103 payments made for either major customer transactions such as house purchases, large corporate transactions, or for the domestic leg of a crossborder foreign currency transaction. 13. The NZClear system is a wholesale payment system for settling securities, equities and cash positions. 14. Direct debits, bill payments, automatic payments and direct credits. 15. Uses the statistics from the above 2015 vs 2010 per head of population analysis, excluding ATM withdrawals. 16. Based on total population of 4,411,800 in Oct 2012 and 4,609,000 in Oct 2015. Population source Statistics NZ. 17. In October 2014, 3.71 million cheques were processed. In October 2015 2.88 million cheques were processed, a decline of 22.4%.