Chapter 2 of the Industry Strategic Investment Case (ISIC) presents an initial foundational ecosystem design. It builds on Chapter 1, which discusses payments modernisation developments globally and details the overarching benefits of a next generation payments ecosystem for Aotearoa New Zealand and the reasons why investment is critical.

Our proposed ecosystem will enable a broader range of participants to develop value-added products and services, with real-time capability playing a critical role in realising the country’s ambitions to become a world-class digital economy.

Our proposed design reflects discussions with payment associations and vendors from around the world, our work to understand the evolution of real-time platforms and the drivers for modernisation, while also drawing on the results of our engagement with industry stakeholders.

We believe our recommended approach will further modernise the payments system in Aotearoa and establish an enduring, equitable and future-proofed payments ecosystem that will serve generations of New Zealanders to come.

Design considerations

Our design is guided by our overarching ecosystem modernisation principle, which states the aim of payments modernisation is to enable innovative and interoperable payments solutions so New Zealanders can pay who they want, when they want and how they want.

In addition to our design principles, five design objectives were developed to help ensure we deliver an enduring next generation ecosystem that balances competing considerations, such as safety and resilience, affordability, and the opportunity for stakeholders to innovate.

Foundational ecosystem design

Our recommended approach rests on:

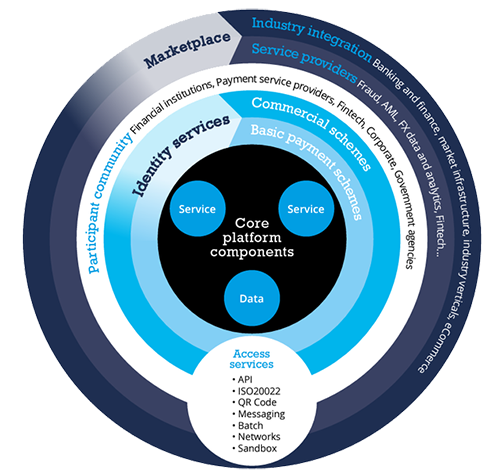

- The delivery of a centralised ‘right-sized’ real-time core platform.

- A modular, building block, approach that enables different payment types and services to be reused and combined in different ways to support new and innovative product development.

- Cost-effective methods of delivery at the platform level to allow services, such as real-time fraud detection, to be made available with less integration effort and improved economies of scale.

- Extensibility, so developers will be able to connect to the core platform to service a broader range of use cases and to deliver innovative product offerings.

The core platform:

- Delivers ubiquitous real-time functionality as standard to all participants in the ecosystem, whether directly or indirectly accessed.

- Is made up of separate components that can be orchestrated to meet desired business outcomes.

- Contains a layer of extended functionality on top of the basic services residing in the core, which can be used or extended to support a particular function, such as fraud detection or customer identification.

Next generation payments ecosystem - architecture perspective

Phasing of ecosystem capabilities

Establishing a next generation payments ecosystem in Aotearoa is predicated on delivering a fully featured base platform in two distinct phases – referred to as Day 1 and Day 2.

Day 1: Real-time push payments and request to pay are available and innovators can connect to the new platform to deliver commercial schemes and begin integrating payments with other industry verticals.

Day 2: The focus will switch to enabling pull payments to help drive adoption and growth.

Once those initial capabilities have been delivered, additional functionality can then be added on, leveraging the extensible nature of the core platform.

Conclusion

We believe acting on this recommendation will mean Aotearoa has a future proofed next generation payments ecosystem that supports competition, innovation, economic growth, and delivery of improved social outcomes for its people.