Connecting the dots – the power of platforms

29 Sep 2017

This September we held our industry event The Hub in Wellington and Auckland to discuss: The power of the connected platform. We had a diverse set of speakers join us to share their perspectives on the global shift towards generating value through a platform approach. Thank you to ACI Worldwide for sponsoring these events.

Setting the scene

Our Chief Executive Steve Wiggins kicked off The Hubs by outlining Payments NZ’s priorities over the coming year, including our collaborative work with the industry on Payments Direction. He also highlighted that our participation and membership programmes continue to prove successful and are growing.

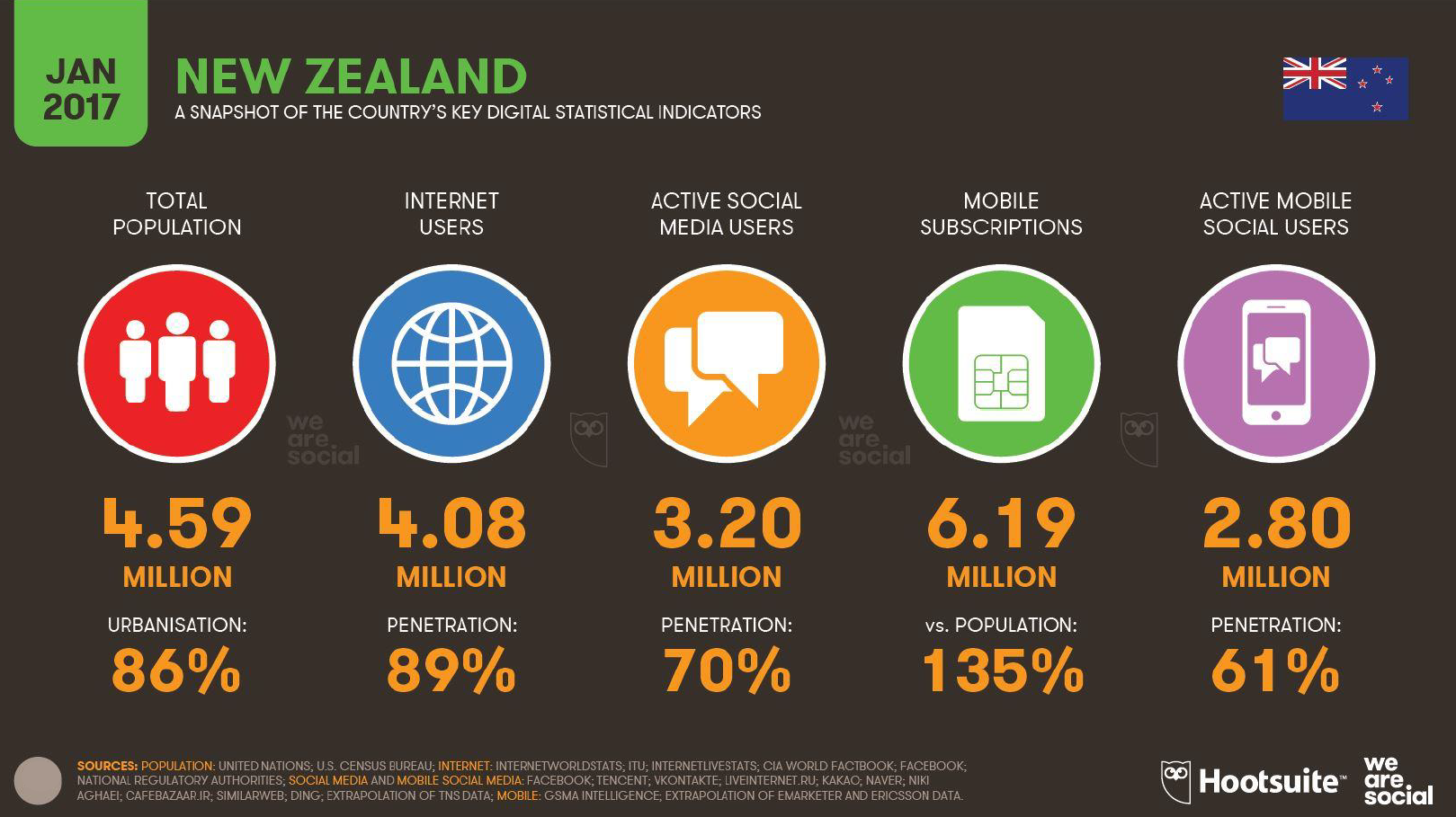

Steve spoke about how, as a digital economy, New Zealand is well-placed to benefit from future innovation in the payments sector. With our work under the Payments Direction umbrella on industry-led initiatives, such as investigating a shared API framework for payments, we were aligned with the worldwide movement towards interoperable, scalable, and replicable platforms.

While the API revolution is one of the most immediate examples of this, disruptive players in every industry aspire to become ‘the’ platform in their sector. For example, in a number of countries Square is known for its nifty point-of-sale bolt-on. However, it is now becoming known as an all-in-one solution for business as it offers financing, analytics, payroll, gift cards and invoicing through a tablet-based application. While none of these services is especially novel, the value the likes of Square brings to the market is in connecting the dots between them.

Payments NZ presentation.pdf (1.2 MB)

Instant platforms

The conversation was then picked up by Craig Ramsey, Director of Product Management at ACI Worldwide, who had come down from the UK to support The Hub. Craig spoke about the growing demand for real-time transactions, and the implications of this for bank operating models and infrastructure.

Craig emphasised that banks shouldn’t think of other digital payments platforms as competitors. Any business that generates non-cash transaction traffic presents an opportunity for financial institutions.

While it’s taken some time for real-time payments to gain traction since their inception in 1973 Japan, Craig says now is the time to realise the major benefits that can be brought by this type of payments platform. To retain and win the customers of the future, it will be in banks’ interest to be able to offer products like Barclays pingit.

ACI Worldwide presentation (1.6 MB)

A helping hand

From Givealittle, Lynne Le Gros presented in Wellington and Melanie Steel in Auckland. Both Lynne and Melanie spoke about this Kiwi crowdfunding platform that provides $18-20 million a year to worthy causes. With only 10 employees, Givealittle demonstrates the huge scalability of successful platforms. However, while they can be low cost, platforms need to be sustainable which is why Givealittle reintroduced their service fee.

Givealittle presentation (585.7 KB)

Brook Anderson and Sonya Williams from Sharesies then spoke about how their platform gives those with $50 the same investment opportunities as those with $50,000. Again, despite significant and growing transaction volumes, Sharesies has only seven staff. It is also looking at leveraging other platforms, like social media, where it aims to generate more conversations about money management by traditionally reserved New Zealanders. They want to make investing fun and social.

Sharesies presentation (3.6 MB)

The promise of platforms

We then facilitated a panel discussion with Craig Ramsey from ACI Worldwide, Chris Wilkinson from First Retail Group, Gary Rohloff from Laybuy and Gerard Creamer from Trade Me.

While the exact issues covered differed between Wellington and Auckland, both highlighted some challenges that need to be overcome for both financial institutions and merchants/retailers alike. There was consensus that to meet the needs of consumers businesses needed to understand and leverage the power of platforms as the collective pieces are greater than the sum of its parts.

Thanks to all the speakers who made this a diverse and thought-provoking event, and to all those who attended. If you’re not already on our mailing list and would like to be invited to the next edition of The Hub, please fill out our email subscription form.

This September event was kindly sponsored by: