Takeouts from the Biometrics Institute Asia-Pacific Conference

24 Jun 2016

The mission of the Biometrics Institute is to promote the responsible use of biometrics as an independent and impartial international forum for biometric users and other interested parties. It was founded in July 2001 responding to an industry need for an impartial forum for sharing knowledge and information about biometrics. There are currently over 200 organisations worldwide that are members of the institute.

Biometrics covers a variety of technologies in which unique identifiable attributes of people are used for identification and authentication. These include (but are not limited to) a person's fingerprint, iris print, hand, face, voice, gait or signature, which can be used to validate the identity of individuals seeking to control access to computers, airlines, databases and other areas which may need to be restricted.

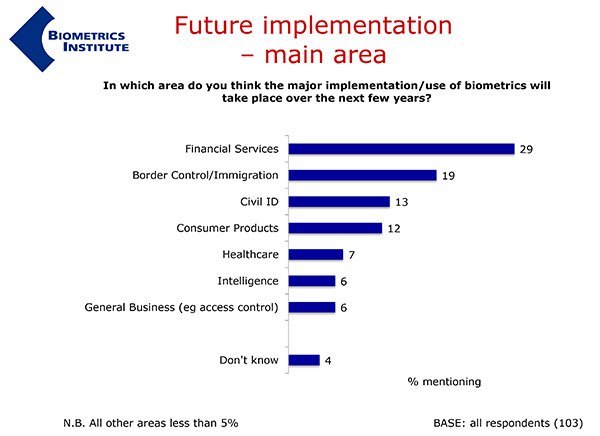

Discussed was the need for the public to feel they are getting value and being protected by the use of biometrics through increased acceptance and trust. However, the public will need to get used to, and adopt, biometrics for it to get growth. The adoption of biometrics within the financial services industry has been slow due to the highly regulated nature of the industry although in a recent survey undertaken by the institute it was considered, by many, to be the main area for growth over the next few years.

Speaker Dave Birch (Consult Hyperion) on the topic of ‘A new Way to Stop Identity Theft’ advised that biometrics is not about identification but authentication once the identification has been established. He believes biometrics should be a convenience rather than a security technology – we already have the biometrics to make this work.

Technology is not the biggest problem to solve, it is interoperability.

Mandy Smith (RealMe) talked about the need for authentication to be multi-channel rather than channel specific as well as the need for collaboration with pressures to lower expenditure and increase efficiency across both the public and private sectors although privacy and ownership issues need to be addressed if data sharing were to be considered.

Despite the OECD issuing some principle-based guidelines some years ago relating to information privacy and individual control of your own information, Fons Kopjes (National Office for Identity Data, The Netherlands) advised the legislation around privacy in this space lags behind the technology. He went on to say experts in the field of ID management agree that there is a need for one clear organisation within each country to take responsibility and manage identity.

Biometrics within the financial services industry is coming, it has already started to arrive and these issues need to be addressed at this early stage in development. This will enable its increased adoption in a standard and structured fashion while ensuring the safety and security of biometrics is preserved.